No More Hustleporn: China's Rise to Dominate Clean Energy

Tweet by Mike Forsythe 傅才德

https://twitter.com/PekingMike

New York Times reporter. Now in New York after years in China. U.S. Navy veteran. Hoya. Views expressed are my own.

CHINA'S RISE to dominate the clean energy revolution is a story that can be told from many angles. The miners in Congo, frustrated US diplomats in DC. Here, I'll show you how Chinese company documents tell their own tale, and can deepen your understanding of China. A THREAD(1/x)

First, read our story, led by @dionnesearcey from in the DR Congo, @EricLiptonNYT in DC. It shows how the tired "great game" rivalry is playing out again in Africa, this time over the new oil - minerals that are driving the clean energy revolution. (2/x)

Global Rivalries Are Miring the Clean Energy Revolution

From almost nowhere 15 years ago, China has come to dominate cobalt production in DR Congo, which produces 2/3s of the world's supply. Cobalt is a key ingredient in many EV batteries. HOW did China come to dominate? There are a lot of reasons. Read the story. (3/x)

In a fundamental sense, China SHOULD BE the world leader in the new energy revolution. After all, it has the world's biggest car market and its manufacturing prowess has helped drive down the price of green energy, from solar panels, and now, to EV batteries and cars (4/x)

But the fact is, it is more dominant in in EVs than its relative size in the global economy. One reason is the massive spigot of money that Chinese state-backed banks have provided to mining companies and manufacturers, up and down the supply chain. Let's take a look. (5/x)

We looked at China in the DR Congo. We wanted to know how much money Chinese financial institutions were lending to Chinese companies to expand their cobalt/copper mining there. For that, I found disclosure a bit spotty (6/x)

Using company announcements and documents like bond prospectuses, I was only able to nail down about $12 billion in financing that went DIRECTLY to Chinese projects in the DRC copper/cobalt mining sector. BUT DEAR READERS, that is only the tip of the proverbial iceberg. (7/x)

First, a Chinese lesson. There are two VERY mighty characters that can help you trace the power of Chinese finance to shape the world economy. They are 授信 (Shòuxìn)which I imprecisely translate as "lines of credit" (8/x)

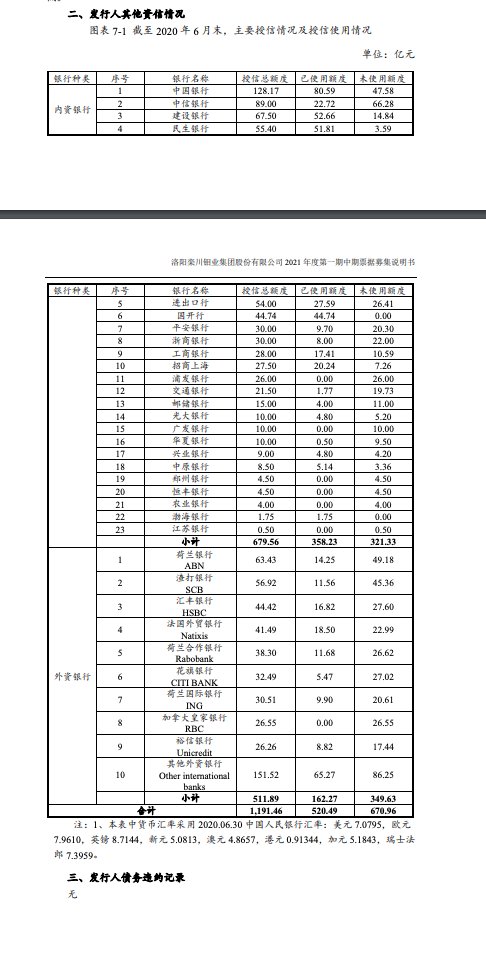

So here's our first doc. This table lists lines of credit given to China Molybdenum (洛阳钼业)the company at the center of our investigation.

It is incredibly detailed, listing the credit lines as of mid 2020 provided by banks, in units of 100s of millions of RMB. All the big banks are there, led by Bank of China. The table lists total lines of credit, the amount already drawn, and the amount remaining. (10/x)

China Moly is listed in Shanghai, but also Hong Kong, giving it access to global capital markets. This chart shows that foreign banks like HSBC have also been lending to China Moly. In all, the domestic banks gave the company about 68 billion RMB ($10.6 billion) in credit (11/x)

Foreign banks provided 51.2b yuan - a lot - but the second column (已使用额度)shows China Moly is drawing down its credit lines from domestic banks much more than from the foreign ones. But China Moly, HUGE in our story, is small compared to some other players....(12/x)

That may be because China Moly isn't a state-owned company. It is state INVESTED - the local Luoyang governments owns about a quarter of the company. BUT JUST LOOK at the money China Nonferrous Mining (中国有色矿业集团) can pull in from Chinese banks. (13/x)

Folks, what you are looking at is China Inc. on one page. China Nonferrous is a state-owned enterprise. It has 194.2 billion RMB in lines of credit ($30.4 billion). Units are in 10,000 RMB here. (14/x)

You can see how China Nonferrous can spend billions to develop the Deziwa mining complex in the DRC. It has a massive warchest of credit (mentioned in story) led by state policy banks like CDB and China Eximbank, to draw from. (15/x)

How does that play out one the ground, how does that money wend its way through the Congolese system? Read this thorough report by Global Witness. Thanks @JeanLucBlakey (16/x)

CNMC and the deal for Gécamines’ flagship copper mine | Global Witness

But China Nonferrous, as awash in state-backed money as it is, has got NOTHING on China Minmetals. 317.8 billion yuan in lines of credit ($47.8 billion). In DRC, that means lots of money to develop the open pit Kinsevere mine. (17/x)

We found that in recent years, the five biggest Chinese mining companies that are operating in DRC have lines of credit from state-backed Chinese banks of AT LEAST $124 billion (we excluded foreign bank lending and lenders we couldn't identify as state-backed) (18/x)

CONTRAST THIS TO THE USA. In 2016, Freeport McMoRan was in financial trouble, so it SOLD its world-class Tenke Fungurume cobalt/copper mine in DRC to China Moly for $2.65 billion. Freeport had made a bad bet on shale/fracking, and it had to raise cash. (19/x)

China Moly, which you now know is a relative MINNOW among the top tier Chinese mining companies, used bank loans from Bank of China and other state-invested Chinese lenders to buy the mine. All told, after acquiring a minority stake from BHR, it paid about $3.8 billion. (20/x)

That was in the closing days of the Obama administration. Then, in the last days of the Trump administration, Freeport sold its rich Kisanfu site to China Moly for $550 million. The USA was out of the copper/cobalt mining business in the DRC. Money woes drove this (21/x)

But now you know that Chinese mining companies in the DRC operated in an entirely different financial reality. The Chinese government is driving financial support for its EV industry, laid out in its national strategy "Made in China 2020." (22/x) T

here are HUGE problems with state allocation of capital. It distorts the economy in China, encouraging wasteful spending on capital projects and holding back the growth of consumption. This is documented by brilliant people like @michaelxpettis . BUT, THERE ARE 2 SIDES (23/x)

When it comes to the new energy revolution, China is in the pole position, and this state-backed financing plays a role. You SEE in the DR Congo how it can help put Chinese companies in advantageous positions over American ones. (24/x)

So much about China's financing can be gleaned from the pages of Chinese bond prospectuses. They are things of beauty. @hjesanderson and I wrote an entire BOOK drawing from these documents when we started diving into them back in 2010. (25/x) See:

Now @hjesanderson is joining @benchmarkmin , which provided us with vital information about the DRC copper and cobalt mines for our story. Thank you. (26/x)

Back to our story. You'll see a lot more from the NYT in coming days and weeks about the DRC and the global race to secure the minerals necessary to power the clean energy revolution. Here's a summary version of this weekend's stories: (27/x)

Race to the Future: What to Know About the Frantic Quest for Cobalt

So I hope you now have a better understanding of the financial advantage these Chinese mining companies have, and see how that is helping them dominate the base of the global EV supply chain. Now President Biden is pushing the US to catch up. But China is way ahead. (28/28) END