No More Hustleporn: Researchers at the BLS and Cleveland Fed released a data series today that might be the single most important new inflation indicator—and I don't say that lightly.

Tweet by Joey Politano 🏳️🌈

https://twitter.com/JosephPolitano

Researchers at the BLS and Cleveland Fed released a data series today that might be the single most important new inflation indicator—and I don't say that lightly.

Introducing the New Tenant Repeat Rent Index—a new way of tracking housing inflation 🧵

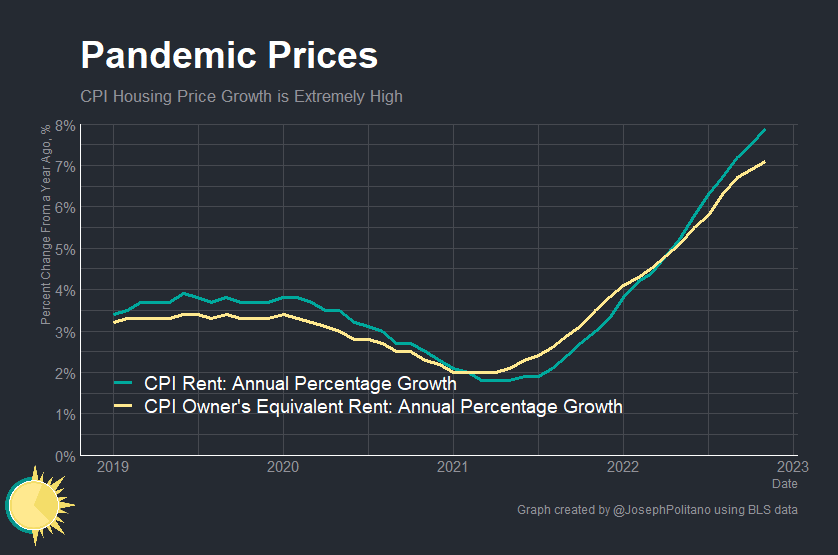

The Consumer Price Index tracks housing inflation through a large panel of housing units that are surveyed every six months.

But because rental turnover is slow and CPI tracks contract rents for all units, CPI data lags current market conditions significantly.

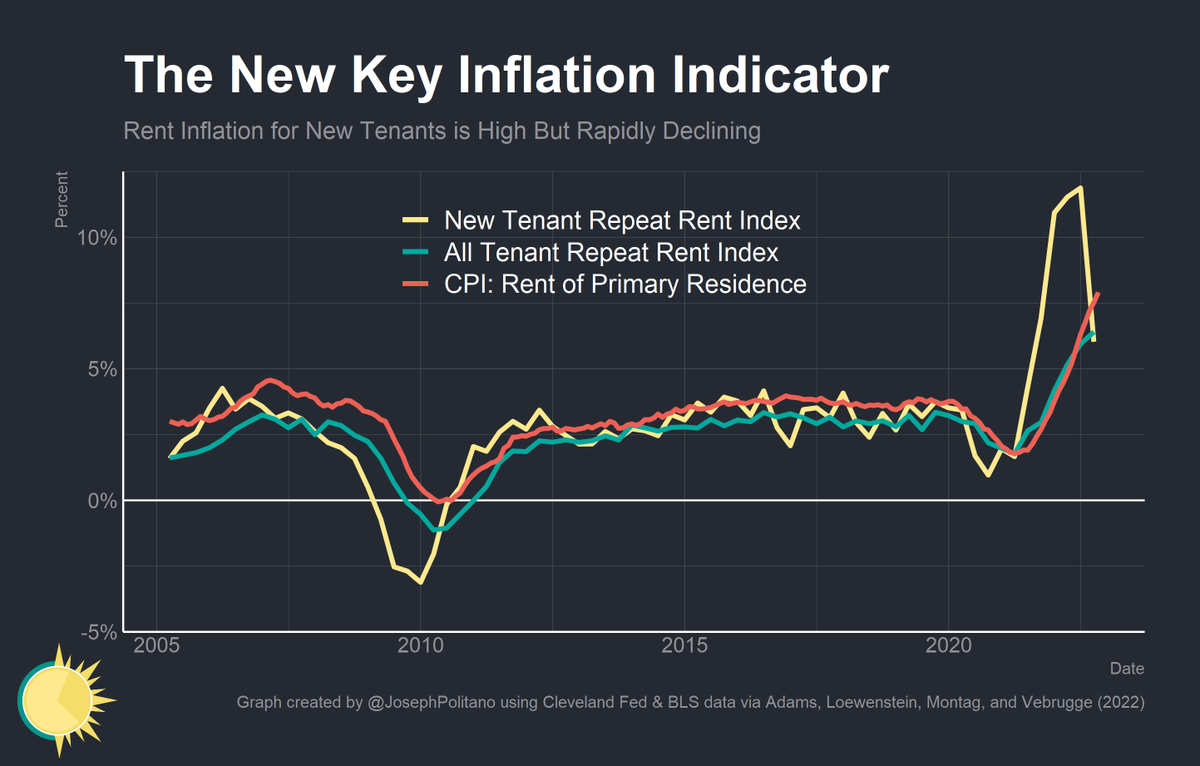

The New Tenant Repeat Rent Index uses the same microdata that goes into the official Consumer Price Index to select only samples with rental turnover and to assign price shifts to when they happened, not when the units were surveyed.

The New Tenant Repeat Rent Index, therefore, leads official inflation data in the CPI by 1 year.

The All Tenant Repeat Rent Index, which has a similar methodology to the official CPI but assigns price shifts to when they happened not when they were surveyed, leads by 1 quarter.

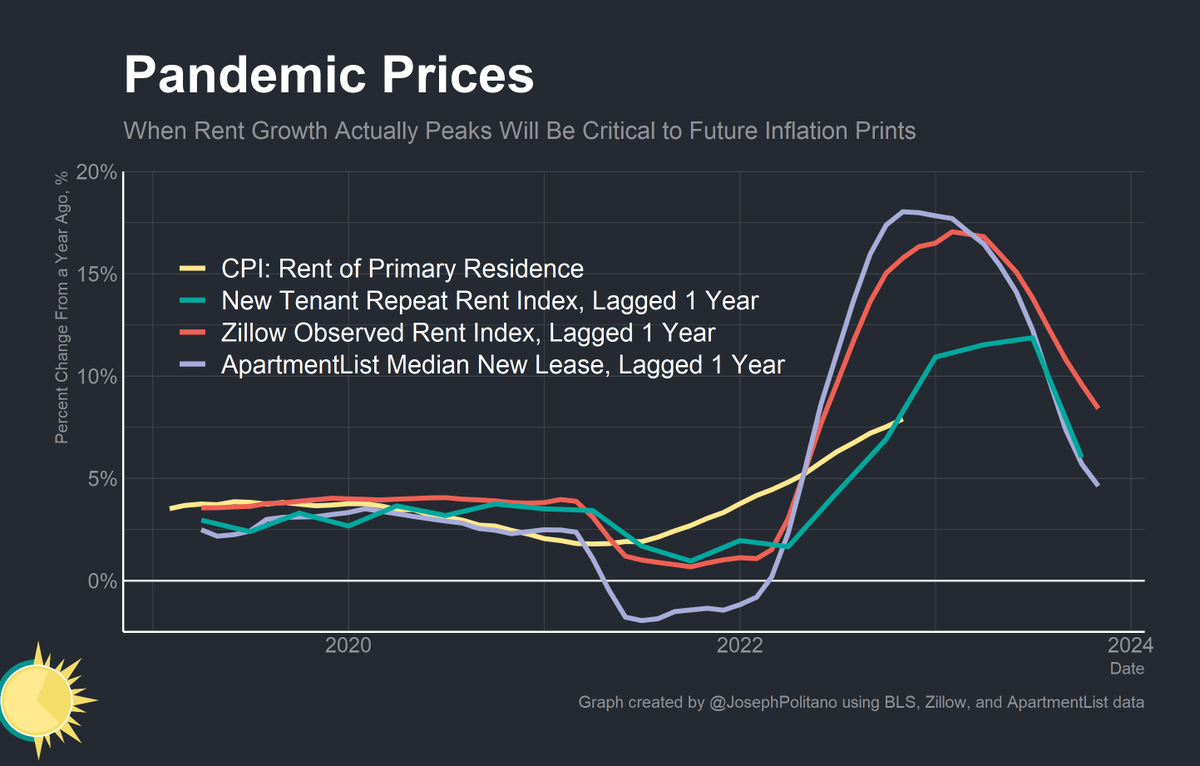

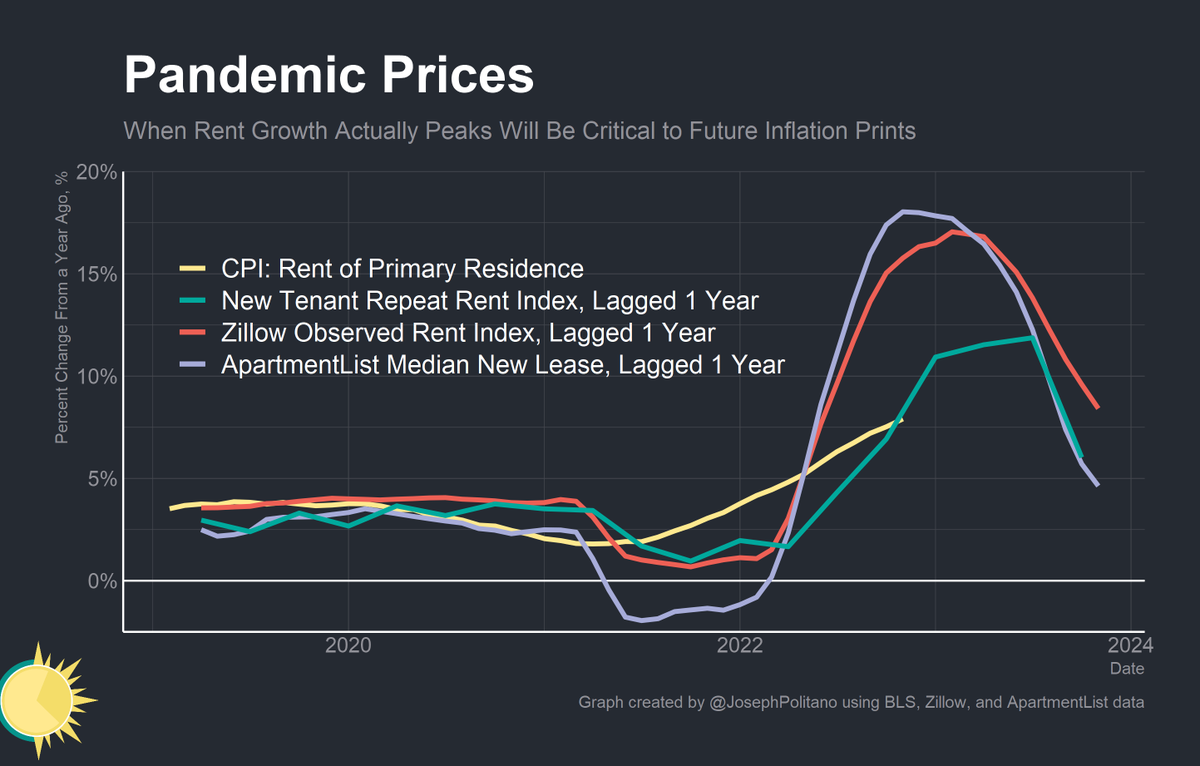

The New Tenant Repeat Rent Index has several key differences between private data from companies like Zillow/ApartmentList.

Namely, the NTRR observes contract rents directly, which private data only imputes from listing prices, and the NTRR is derived from a more robust sample.

The good news is that the New Tenant Repeat Rent Index suggests that the worst of housing inflation is likely behind us and price decelerations should pass through to official inflation data soon.

Critically, NTRR also shows lower overall price growth than private data.

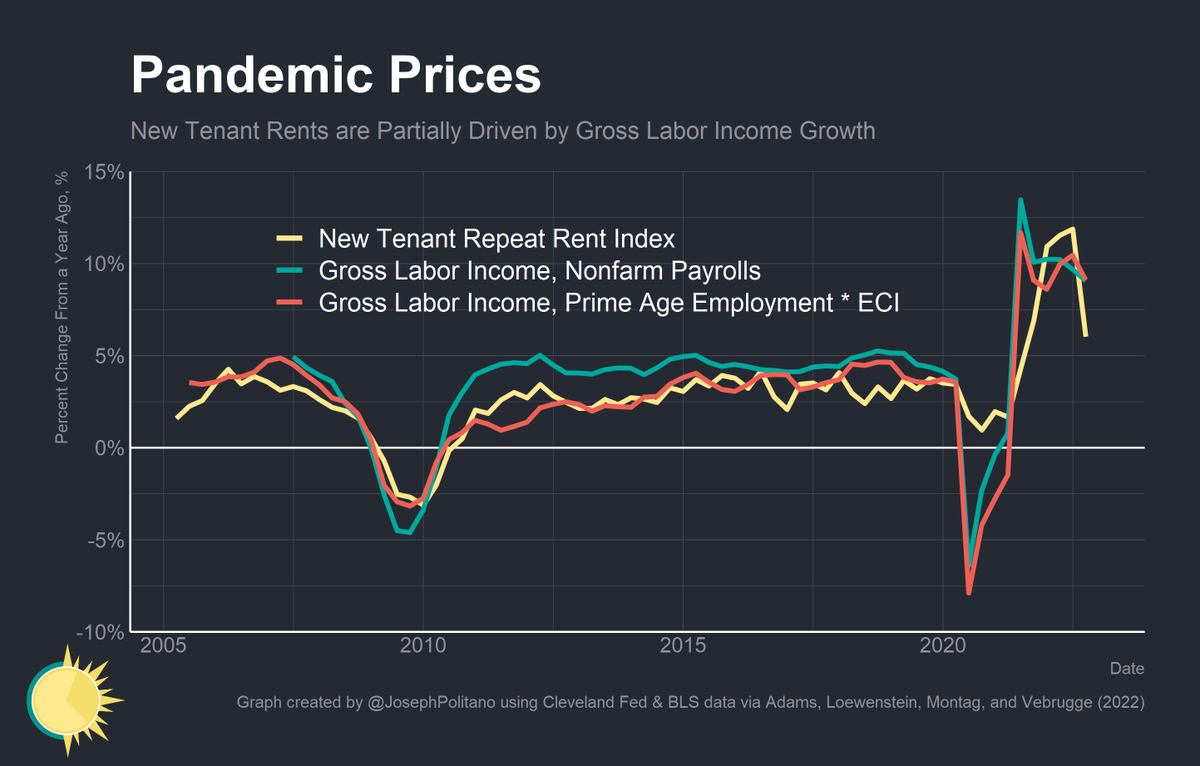

The New Tenant Repeat Rent Index also tracks much closer with movements of Gross Labor Income (aggregate wages) and with much less of a lag than official CPI data.

Slowing GLI growth is a key mechanism by which the Fed controls inflation, making NTRR a key indicator to watch.

One key note—since the NTRR is a repeat-rent index, it is revised as new observations are added over time. Recent measurements could change when new CPI data is collected, and data for the most-recent quarters also have the largest confidence intervals.

Credit to Brian Adams, Lara Loewenstein, Hugh Montag, Randal J. Verbrugge for creating these series and all the people at the BLS and Cleveland Fed for their amazing work on this.

You can find a link to the working paper and data below:

I plan on writing a full article dissecting these indices in the near future, so please subscribe to my newsletter to receive that when it comes out!