No More Hustleporn: Snowflake CFO Mike Scarpelli recently spoke at a Barclays Global Tech conference

Tweet by Austin Lieberman

https://twitter.com/LiebermanAustin

@LiebermanAustin:

Snowflake CFO Mike Scarpelli recently spoke at a Barclays Global Tech conference

Here's what he had to say about the state of Snowflake's business and how the weakening economy is impacting cloud vendors

I'm a shareholder, so I've included a basic DCF analysis at the end

$SNOW

@LiebermanAustin:

Q: What do you see in terms of new customer business?

A: No change. When a customer has decided to move to the cloud they aren't making decisions for the next 3 to 6 months. They are making 10 - 15 year decisions

Our average time to close in 7 months, large customers 1-2 years

@LiebermanAustin:

Snowflake's top 15 global system integrators (GSI) have sold $1.425B YTD in services around Snowflake to new customers.

This is a big change compared to 3 years ago. $SNOW used to face the challenge of not being understood. Now, GSIs are regularly certifying people in Snowflake

@LiebermanAustin:

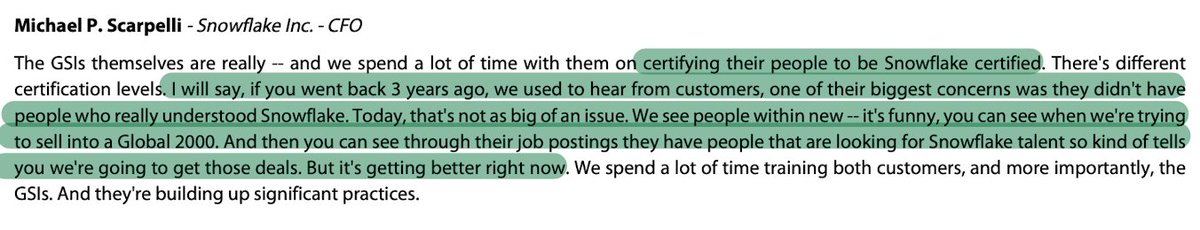

On Snowflakes best-in-class 165% Dollar-based net revenue retention.

This is one of the most important metrics for a software business and to my knowledge, no other public business has DBNRR that's even close. Especially at a $2B revenue run rate...

@LiebermanAustin:

Q: How do you explain your crazy-good revenue retention?

A: It's driven by our largest customers expanding quickly. 6 of our top 10 customers grew faster quarter-over-quarter than the company's growth rate.

*3 customers in the crypto industry reduced by $41.8M this year

@LiebermanAustin:

On Snowflake competing with cloud hyperscalers (Google, Microsoft, AWS):

Google is the most competitive. We rarely win any Azure accounts, AWS tends to partner with us more than the others.

@LiebermanAustin:

Q: How is the uncertain macro environment impacting $SNOW since you use a consumption-based model and not a standard subscription model?

A: "I'd be more concerned if we weren't in the growth stage (early innings) of migrations with customers. We are shifting to sell on value..."

@LiebermanAustin:

"Data is becoming one of the core assets for companies today. There's a large oil and gas company that we sold $3 million worth of Snowflake to. They themselves say they see $30 million in value. My comment was that we sold them too cheap."

@LiebermanAustin:

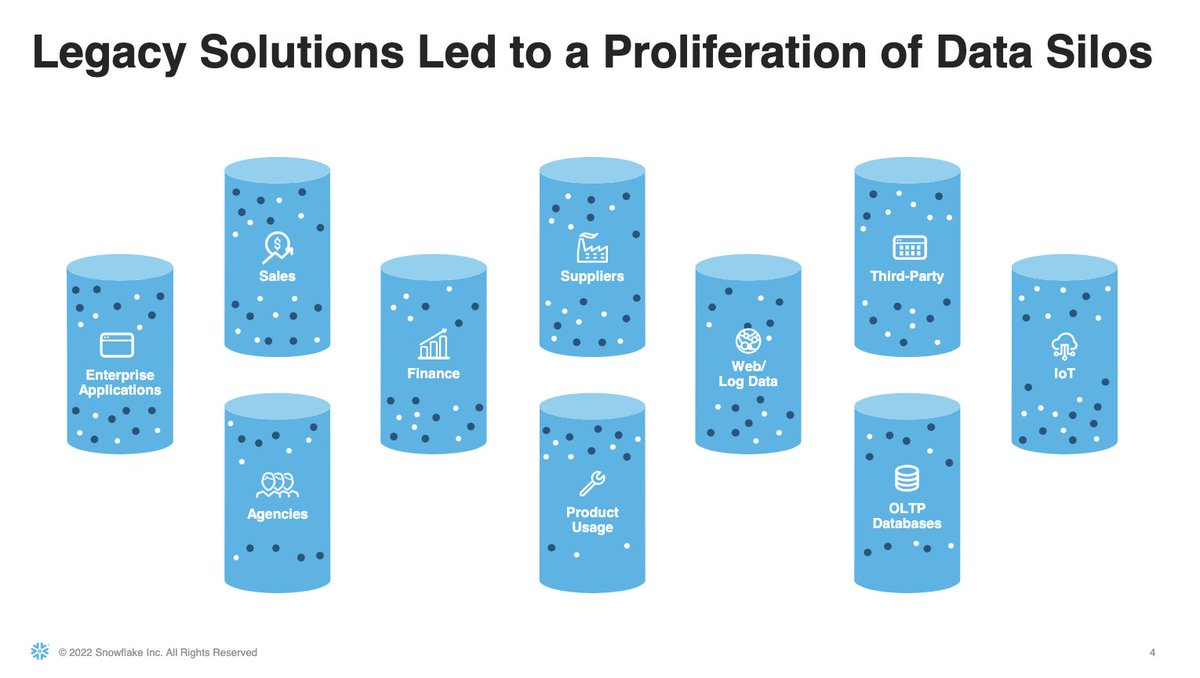

Q: How are you seeing the use-case change for Snowflake?

A: We are fundamentally changing customers' relationship with data. We are eliminating data silos. We get all your data in one place which improves security and cuts costs....

@LiebermanAustin:

"It is our belief that there will be a world where instead of bringing data to the applications, we bring the applications to the data. We fundamentally think Snowflake can become an application development platform where you have all the data without having to move it."

@LiebermanAustin:

Q: Why does AWS see you as more of a partner and less of a RedChip competitor?

A: We can operate at scale. I believe we are AWS' biggest ISV. We are becoming very meaningful to AWS and are renegotiating our contract with them which will include more commitments from them.

@LiebermanAustin:

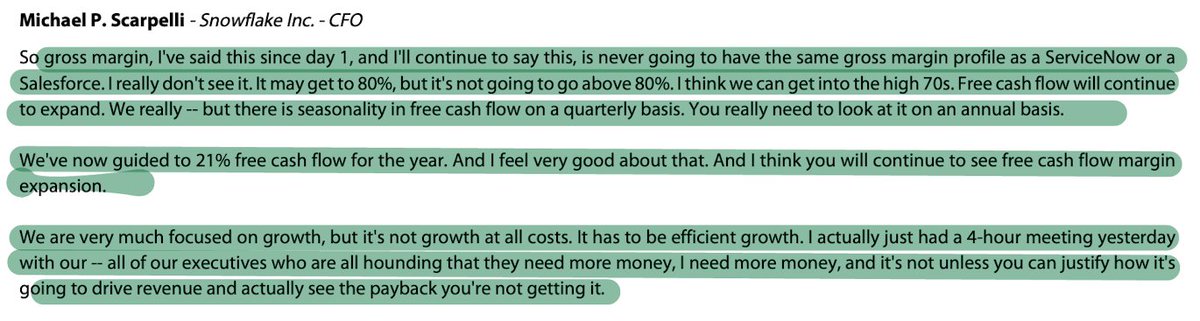

Q: Can you share your outlook on gross margin and profitability?

A: We will never have the gross margin of Salesforce or ServiceNow. We may get to 80% but not above. Free cash flow will continue to expand. We've now guided to 21% FCF for the year.

@LiebermanAustin:

"I just had a 4-hour meeting yesterday with all of our execs who are all hounding and saying they need money. If they can't justify how it is going to drive value and payback, they aren't getting it."

This discussion is probably going on inside every company right now

@LiebermanAustin:

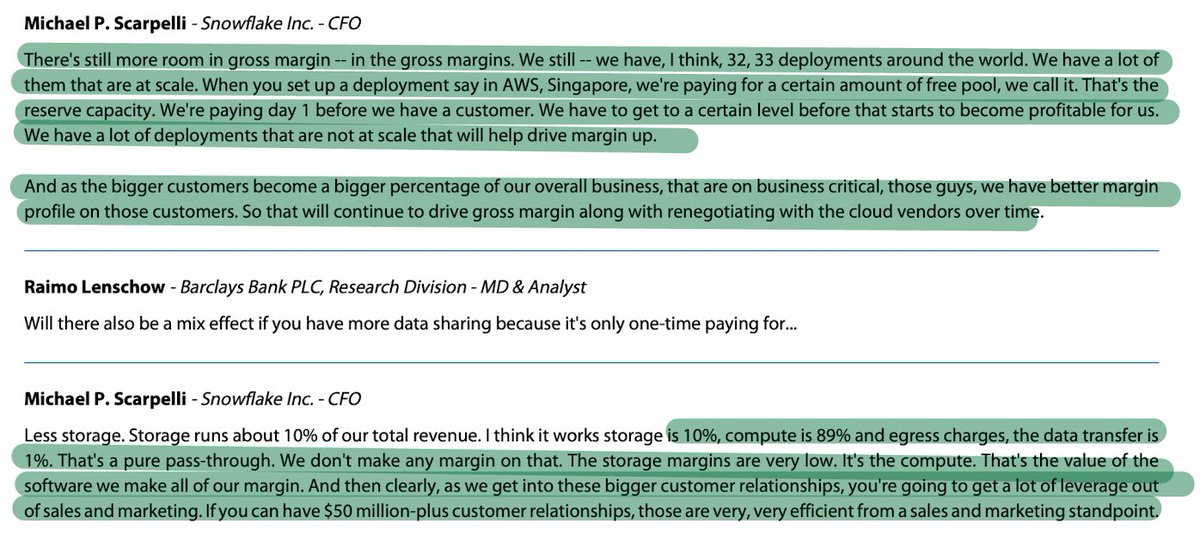

Snowflake's gross margin will naturally improve as they land more customers because they have to pre-pay for their capacity.

@LiebermanAustin:

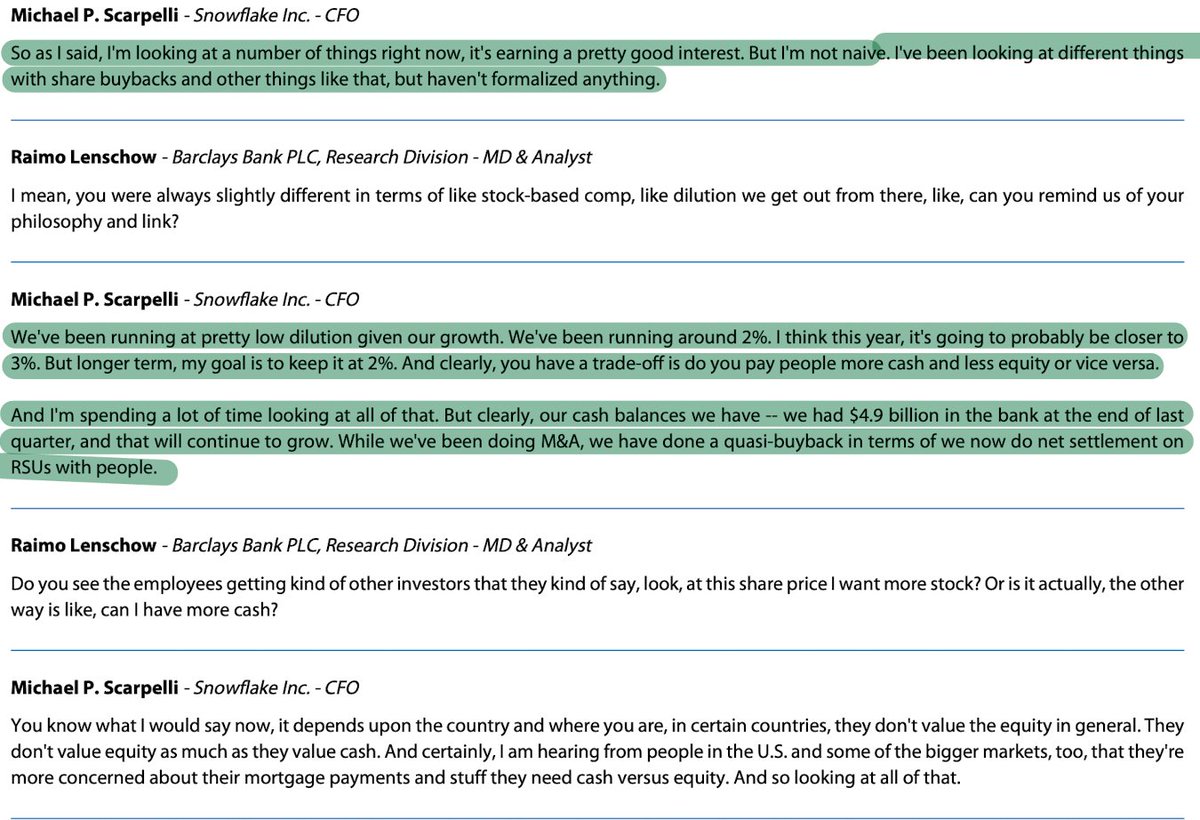

*EVERYONE's BIGGEST CONCERN*

Stock-based compensation

"My goal is 2% dilution. We have $4.9B in the bank (growing) and I'm considering doing a number of things from small acquisitions to share buybacks. But nothing has been formalized"

@LiebermanAustin:

So $SNOW is certainly seeing the impacts of a weakening economy which has caused some short-term headwinds. But the company is well-capitalized and believes plays a key role in the next phase of critical digital infrastructure - the data cloud -

@LiebermanAustin:

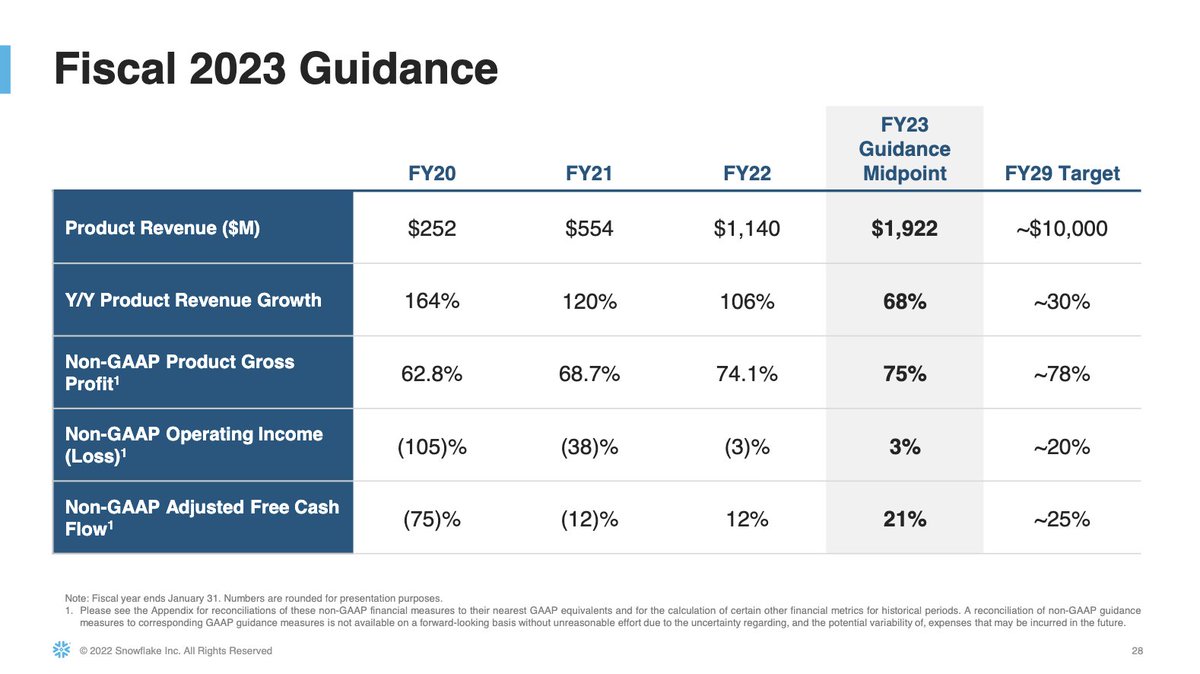

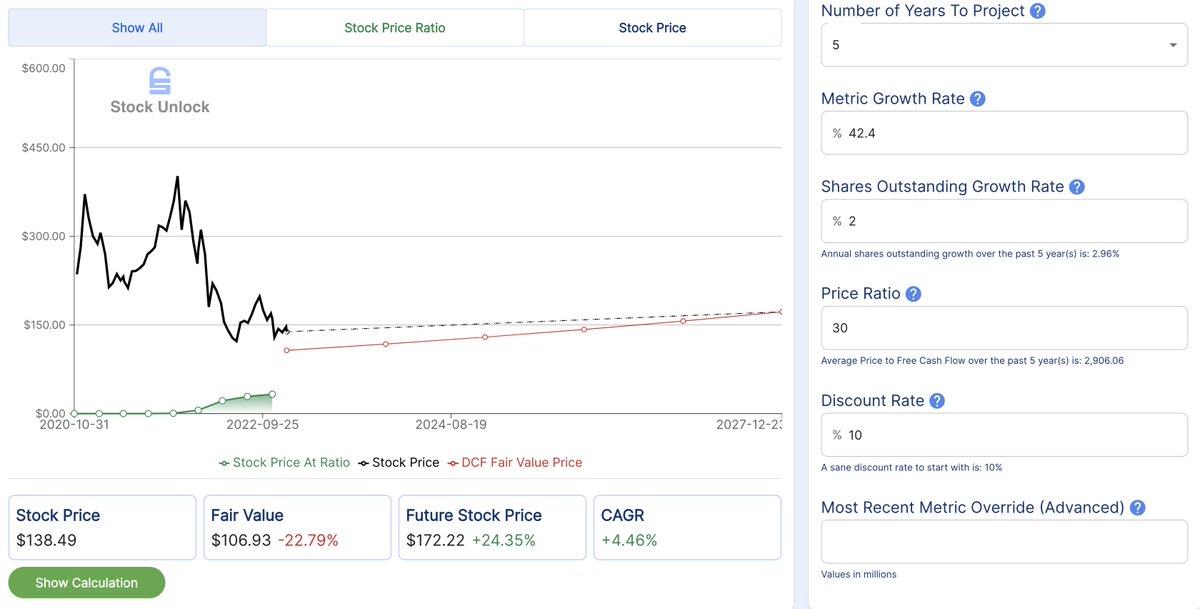

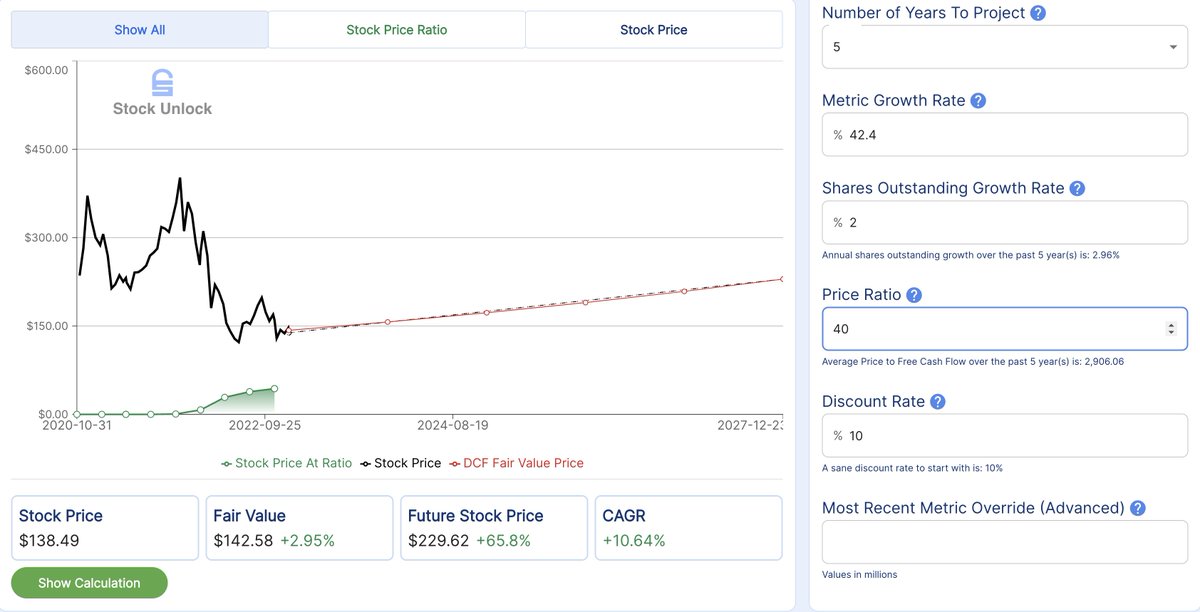

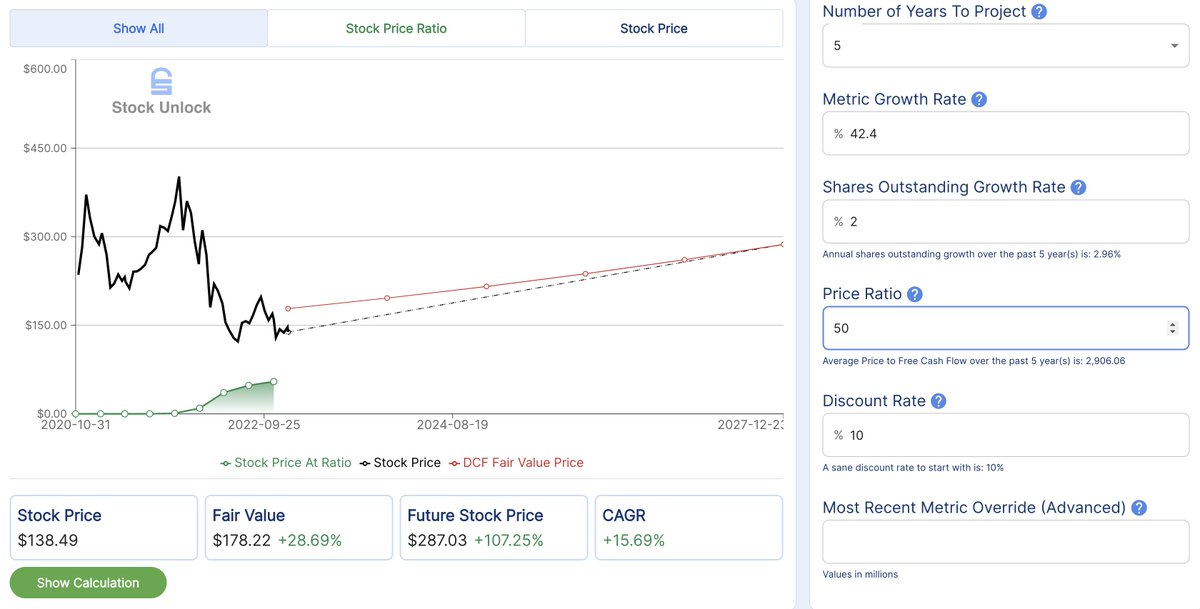

Finally, my Fair value using a discounted free cash flow analysis. The goal here is to have a rough idea of what needs to happen for an investment to work out.

Bear: $107 | '27 CAGR: 4.5%

Base: $142 | 10.6%

Bull $178 | 15.7%

How I got there

@LiebermanAustin:

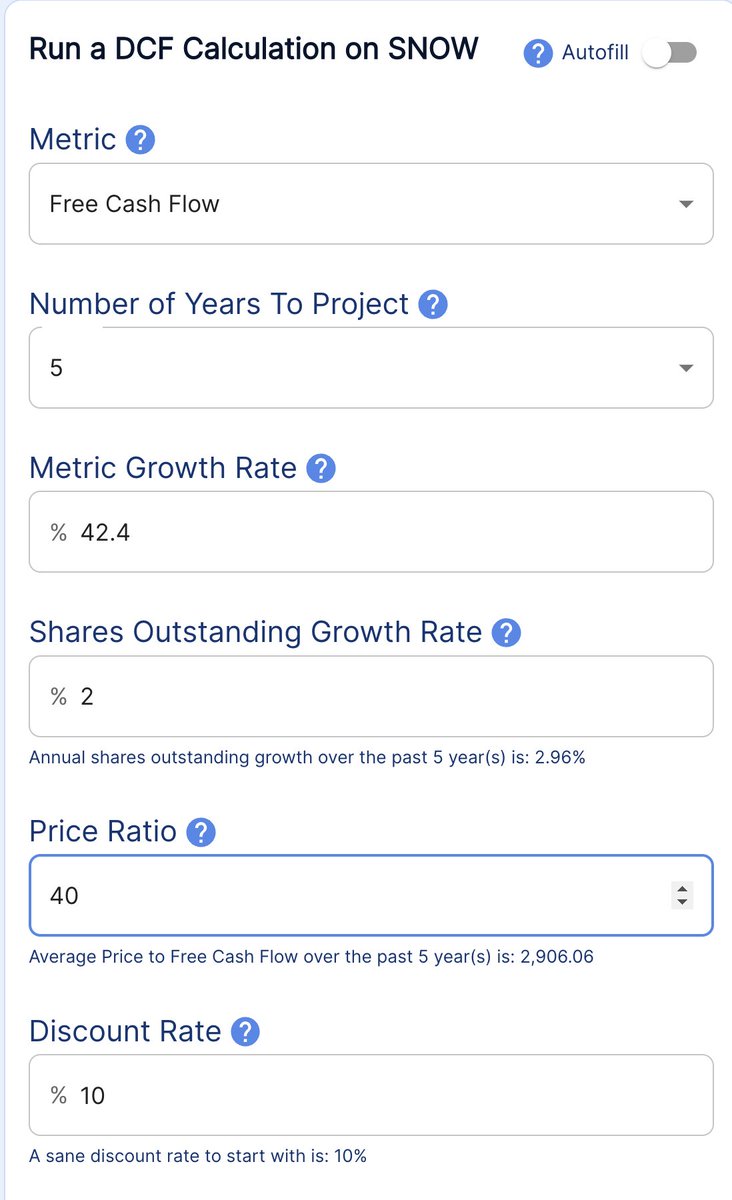

I used analyst est out to 2027, which are based roughly on management's long-term targets. Analysts expect $8.6B in revenue growing at 36% YoY and FCF of $2B (23% FCF margin)

42.4% FCF growth gets us to $2B in '27. Then I added 2% dilution and did a P/FCF of 30, 40, and 50

@LiebermanAustin:

So the question becomes. Which scenario do you believe is most likely? Does management deserve your trust with their long-term targets? Do you believe $SNOW is more likely to trade at a P/FCF or 30, 40, or 50 in 2027?

@LiebermanAustin:

For me, over the short-term, I don't know how low the stock goes. But when looking at the size of their market, the past proof of execution/product demand, management's experience, etc

I'm comfortable with the Bear case and think base, bull or somewhere between is more likely

@LiebermanAustin:

But for me it all comes down to the fact that as long as the fundamentals show the business is still winning. We are still in the very early stages and 2027 will still be early. $10B in revenue by 2029 is still early.

So I'd love to hold $SNOW for 10 - 20 years.

@LiebermanAustin:

My DCF is certainly wrong. I have no idea what will actually happen, but I have a good guide and I know what metrics to watch. As long as the business is trending in the right direction I will use my bear case as an area to accumulate (while keeping my position size reasonable)

@LiebermanAustin:

If you enjoyed this thread, I think you'll enjoy my free newsletter, where I take a thoughtful approach to long-term investing.

austin.substack.com