No More Hustleporn: Explaining Snowflake

Tweet by Dan Cahana

https://twitter.com/dan_cahana

VC @GGVCapital | Previously @GeneralAtlantic@Penn

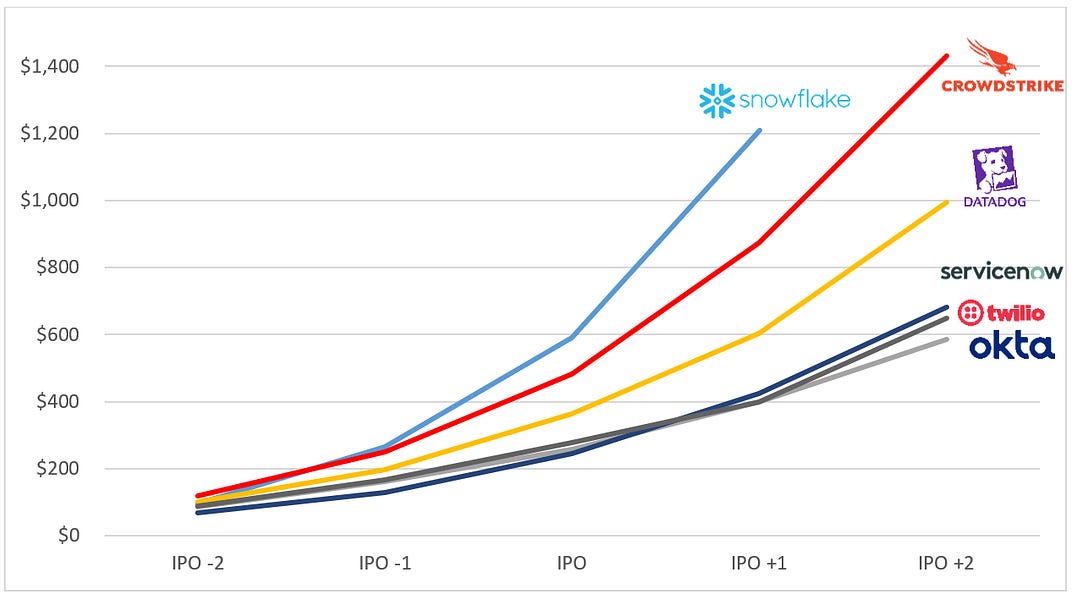

(1/13) Since its recent acquisition of @streamlit, I've been thinking about Snowflake's role in the data ecosystem and what its success means for startups. TLDR, more startups are building around Snowflake, and the opportunity is massive. More below⬇️

(2/13) Snowflake's success is (literally) unprecedented in the history of software. The pace at which they're gobbling up enterprise data can be daunting for new startups. But I believe their success creates a foundation for many new opportunities

(3/13) In removing constraints around the cost and scalability of data storage, the CDW has pushed data teams to store far more data than ever before. But managing and making use of that data is still very difficult at scale. I’m seeing 3 buckets of startups step in to help:

(4/13) Unbundling Data Eng - managing data platforms used to require an army of data engineers. That’s infeasible for most companies. Tasks like pipelining (@fivetran) and observability (@montecarlodata) are being productized, reducing what data eng teams need to custom build...

(5/13) The startups building those tools are hitting the market in stride, with thousands of companies now bought into Snowflake and trying to make the most of their investment in the warehouse

(6/13) Broadening Data Consumption - for most companies, making use of data amounts to batch-based BI dashboards. That’s not the vision folks have in mind when they commit to becoming “data-driven.” Startups like @sigmacomputing are lowering the barrier to entry for BI...

(7/13) while others like @pecan_ai are helping analysts build full predictive models. At the same time, @startreedata and @MaterializeInc are enabling a shift to real-time, actionable analytics

(8/13) Snowflake as an Operational Back-End - Snowflake is slowly starting to move from an analytical to a transactional database. This could represent a massive shift in the way software is built, de-coupling the app from the database and opening up new market opportunities...

(9/13) Reverse ETL tools like @getcensus and @HightouchData already feed workflows in business apps, and a crop of startups are replacing traditional solutions with apps build on Snowflake, notably across SIEM (@runpanther_, @hunters_ai) and CRM (@headsupai, @GetCalixa)

(10/13) It's hard to overstate the impact of this transition. Separating the app and db layers would mean lower switching costs for customers and less lock-in for vendors, opening up markets previously won on data moats (Salesforce in CRM, Splunk in SIEM) to new competition

(11/13) none of this will happen overnight, but Snowflake's success has opened up a massive wedge in the market for ambitious founders.

(mandatory commercial) I'm super excited about backing those founders @GGVCapital and @InvestInData

(12/13) I'm planning to write more about the startup ecosystems being enabled by infrastructure software success stories ($CFLT, $HCP, $NET, $CRWD, etc.), among other things. If you found this interesting, feel free to subscribe to the newsletter

(13/13) and a big thank you to @glennsolomon, @aashaysanghvi_, @meaganloyst, @DiegoLiranzo, and @matt_slotnick for your help thinking through these ideas and iterating on drafts 🙏

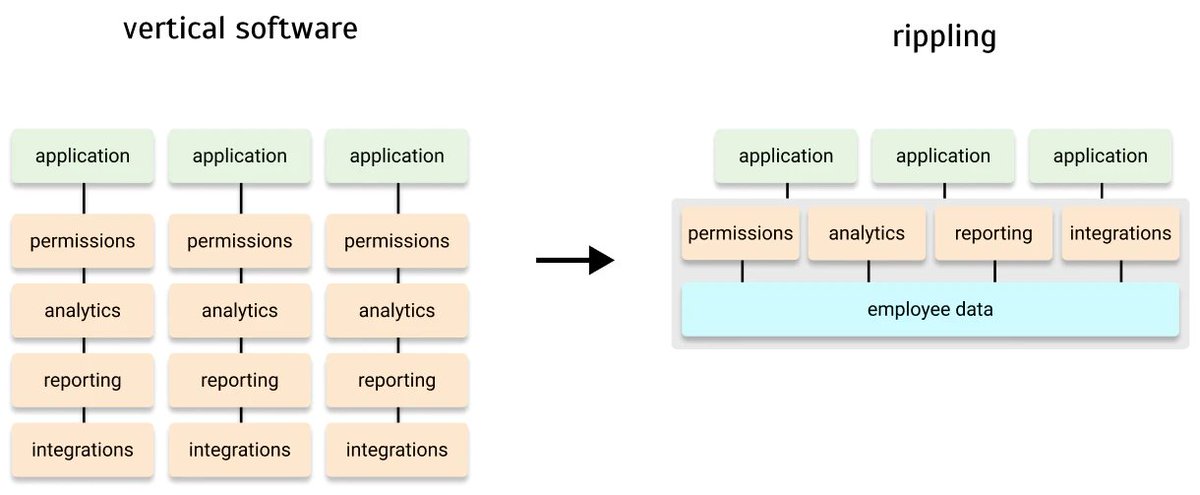

Finally got around to @absoluttig’s excellent Rippling analysis this weekend. Similarly points to the benefits of a shared underlying db across more apps, in this case in more of a “walled garden” and focused on SMBs. Customers clearly already seeing the advantages