No More Hustleporn: A lot of panic re: SVB (you should see my phone/emails!). A bank run driven by panic is the real risk here, not the action of selling LT securities at loss

Tweet by samir kaji

https://twitter.com/Samirkaji

@Samirkaji:

A lot of panic re: SVB (you should see my phone/emails!). A bank run driven by panic is the real risk here, not the action of selling LT securities at loss

I have no inside information as I left SVB in 2012, but know enough about banking to piece together.

Quick 🧵

@Samirkaji:

1) First, one of the core KPI's of a bank is Net Interest Margin (NIM); basically the delta between what it earns on assets (loans and securities held) vs. cost of funds.

Most banks try and get in the 3% range

@Samirkaji:

2) SVB's NIM is 1.89% per their recent filing.

NIM can decrease when cost of deposits increase (higher rate environment), and when the assets yield less, because of competition (lower loan pricing), LT fixed rate loans, and if securities held no longer yield a market rate.

@Samirkaji:

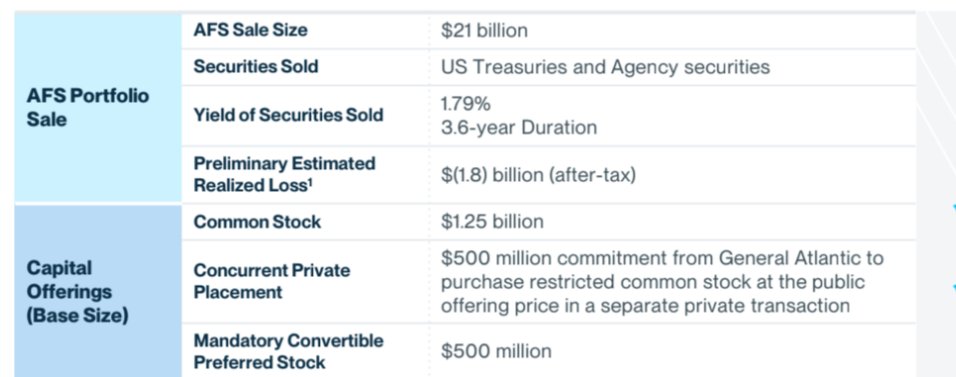

3) In this case, they sold $21B of medium duration securities at a $1.8B loss. These were yielding 1.79%, so selling instead of holding to maturity is a strategic move to reposition the balance sheet (increasing asset sensitivity).

@Samirkaji:

4) This is akin to ripping of the band aid, but converting these available for sale securities to short duration, higher yield securities. Over time, this increases NIM while perhaps providing a better NI impact as rates stay high (they believe a 3 year payback)

@Samirkaji:

5) IMO this is a healthy re-positioning, even if painful (and drops the Moody's rating). The raise, which includes General Atlantic is also strategic (GA folks are really smart, and I doubt they would infused 0.5B if there were real liquidity concerns)

@Samirkaji:

6) Additionally, if you look at the 10K and look at overall liquidity and bank tier ratios, I would not analyze this as a "crisis" (liquidity is still very healthy). The $2.25B total raise is to further shore up the balance sheet. Short term pain comes with this.

@Samirkaji:

7) The big risk here is panic as I've seen a lot of VCs tell their companies to move funds. Bank runs are very dangerous and pose the real threat (deposits are liabilities).

While a bit of concern is understandable, IMO the risk isn't an existential crisis.

@Samirkaji:

8) But rather a recognition of the rate environment, and needed to improve key metrics like NIM. Additionally over 50% of their loan book is low-risk capital call lending to private funds, not high risk early stage debt.

@Samirkaji:

9) It's up to every entrepreneur or VC to react as they see fit, but wanted to provide a bit of color from a former banker.