No More Hustleporn: I helped someone evaluate a startup offer letter this week as they weren’t sure how to evaluate their stock or cash comp.

Tweet by Alex Cohen

https://twitter.com/anothercohen

I helped someone evaluate a startup offer letter this week as they weren’t sure how to evaluate their stock or cash comp.

I don’t think most people know what to look for, so I thought it would be fun to publicly share how we broke down their exact offer for Twitter:

Quick disclaimer: I partnered with @jrdngnen and

again to make sure I didn’t fuck up the important pieces around equity grants.

Thanks for making me sound smart!

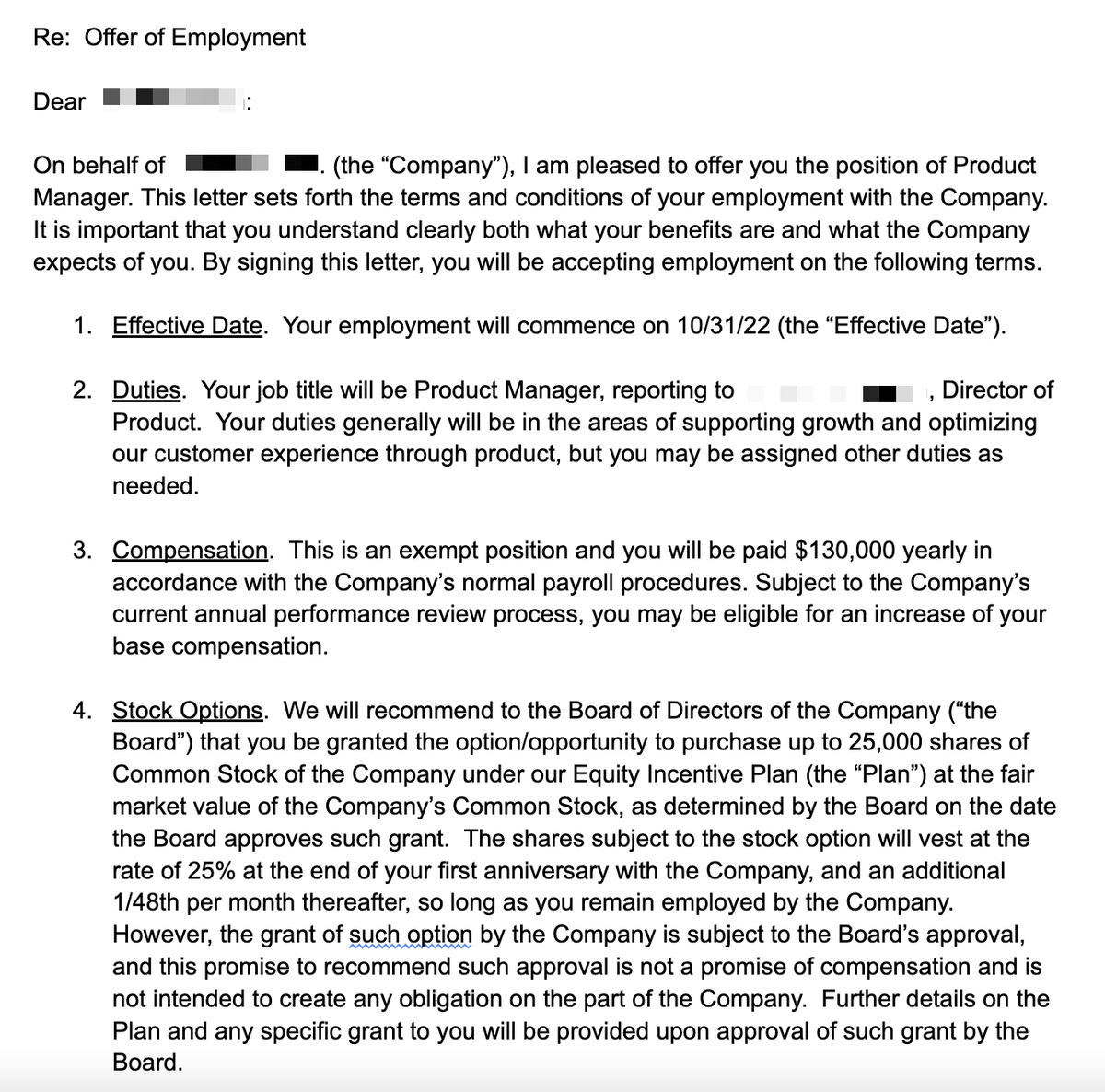

First, here was their offer.

Note that the role requires they be in person, based in San Francisco, and this is a fairly large, private company (Series C).

In a nutshell:

• Product manager role

• $130k base salary

• 25k stock options w/ a 1 year cliff and 4 year vesting period

• At will employment

• Healthcare benefits

Not bad at first glance for only being 2 years out of school!

First, cash is king. I love startup options as much as anyone but they don’t pay the bills.

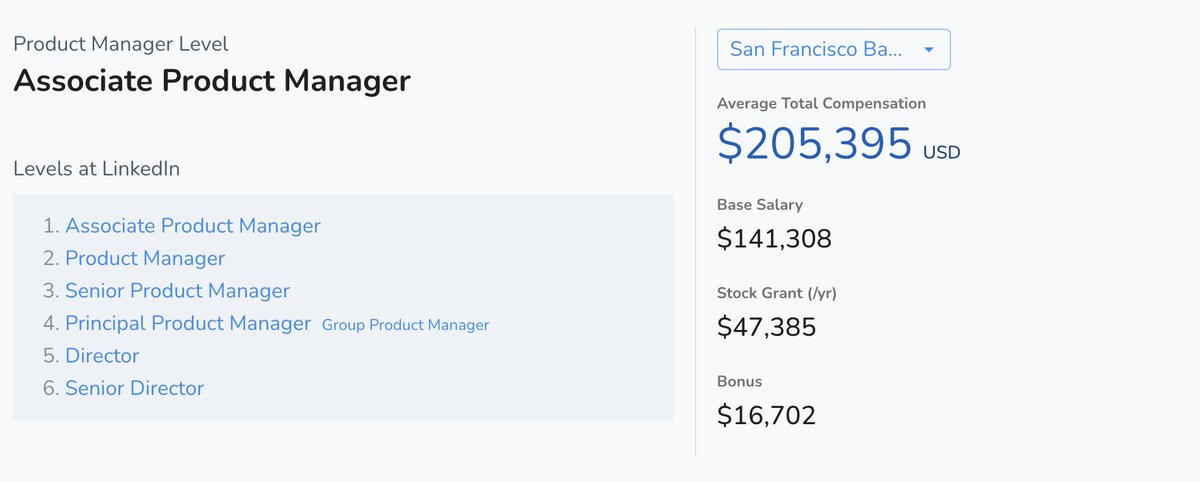

130k for a Jr. PM with 2 years of experience seems good, but we looked at Levels to compare. I found the cash comp to be a bit under what APMs make at LinkedIn (a good comp for the role).

A more senior PM at LinkedIn actually makes closer to $175k base salary and double the stock, but the APM role is more aligned with a PM role for a junior employee at a Series C company.

If this was their second PM role, we would have compared the PM role instead.

With the salary now checked off, we dove into the stock grant.

This part is tricker and typically where most people don’t know what to look for or what to ask. Because these are ISOs, we asked for:

• Strike price

• Last 409A

• Preferred PPS

• Post termination exercise window

We learned that the strike price was $2 and the current preferred price per share was $10 w/ a post termination exercise window of 7 years.

This means:

1) If they plan to early exercise, it’ll cost $50k ($2 * 25k shares)

2) The fully vested, current “value” of the stock is $250k

A 7 year post termination exercise window is solid.

Many startups only offer 3 months to exercise after quitting or being let go and many employees lose their stock grants because they can’t come up with the cash.

7 years is great to sit tight and hope for a liquidity event.

I wrote about this in this thread:

Several friends have now quit or been laid off from their jobs at startups and have asked me what to do with their options.

Not exercising could mean millions left on the table, exercising could mean liquidating a huge chunk of cash that could go to 0.

Here are my thoughts:

But evaluating private company stock is hard. At the current preferred price, we back into TC (total comp) of $130k + $62.5k (250k stock / 4 yrs) = ~$192k/yr

If the company does well and has a liquidity event at >$10/share, the value goes up!

More here:

$192k/year is slightly less than what APMs make at LinkedIn, so this seems right for company stage.

We spent time discussing if this salary is fair given risk:reward ratio. LinkedIn stock is public/liquid, while this stock is private until an IPO, acquisition, or secondary.

But, this company has more potential to 5-10x, while it would be unlikely for MSFT (LinkedIn parent company) to become a $10T company.

A bullish outcome means that in 3-5 years, this stock grant could be worth $2.5m and TC over the same 4 years would be $765k!

That’s good!

However, with the way the market is, it’s better to just assume the stock is going to $0 or liquidation preferences eat any proceeds from an outcome and leave common with $0.

In that case, we asked “do you like the company enough to just make the base salary?”

The biggest problem with evaluating offers is that we’re making decisions with limited data.

Idk how much revenue this company is making, the sales pipeline, growth rate, future plans, etc.

We can ask for it all but likely won’t get this info, so we’re making a gut decision

With limited data, the questions we evaluated were:

• Is the base salary enough to be happy and pay the bills?

• Does this role accelerate your career?

• Do you like the work?

• Are you excited about the team you’re working with?

Ultimately, they weighed career acceleration to be the most important, and with a very clear “yes” to that question, made the decision to take the offer.

If you’re currently evaluating a job offer, I hope you found this thread helpful.

If you need expert advice regarding your offer and stock options, I’d recommend signing up for a platform like

, who specializes in startup equity and wealth management for tech employees